The decade proved to be full of critical developments for both small-caps and our firm. The '90s saw dynamic performance for smaller companies, causing the sector to grow more popular, and the parameters of what constitutes small-cap expanded by the middle of the decade to include companies with market capitalizations up to $1 billion.

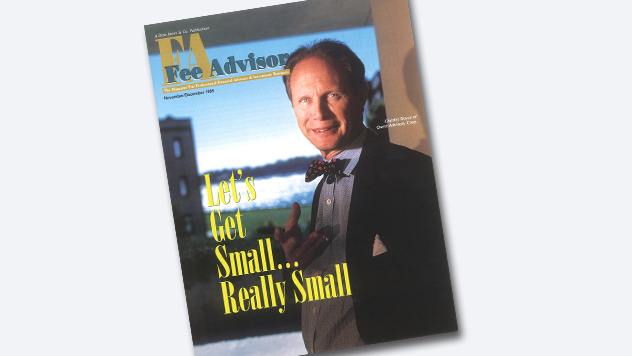

Chuck Royce on the cover of Fee Advisor, 1995

The increase in both cap size and popularity meant that small-cap stocks evolved; they were no longer quite as small, unknown, or under-owned. As of December 31, 1999, the weighted average market capitalization of the small-cap Russell 2000 Index was $1,360 million, compared to $140 million as of June 30, 1985.

Small-caps also gained increasing recognition as a professional asset class, with much of the growth in mutual fund offerings occurring between 1992 and 1997. Morningstar listed only 20 small-cap funds in existence as of December 31, 1982. This compared to 98 funds as of December 31, 1992 and 301 as of December 31, 1999. (The Morningstar universe of small-cap funds includes only the oldest share classes of funds that fall under the Morningstar Category of Small Blend, Small Growth, or Small Value.)

The asset class underwent other related changes. Early in the decade, we began to observe that the small-cap market was bifurcating into two distinct sectors based on capitalization: small-cap and micro-cap. What we learned from these observations had a lasting effect on the way that we structured our portfolios going forward. (And the contours of this shift remain in place, even as the market cap ceilings have risen over the last 20+ years.)

Micro-cap stocks (which we currently define as those with market caps up to $1 billion) offer many choices but also have limited trading volumes, higher volatility, less liquidity, and little, if any, research coverage. We therefore choose to broadly diversify our portfolios that invest in micro-cap companies.

Small-caps (which we currently define as those companies with market caps from $1 billion to $3 billion) is more efficient, offering greater trading volumes, narrower bid/ask spreads, greater liquidity and generally more widespread analyst coverage. In this, they resemble the bigger mid- and large-cap siblings. We thus felt comfortable limiting the number of positions in our small-cap strategies, typically holding less than 80 companies, which continues to this day.

This recognition of the distinction between small and micro-caps led us to introduce the more concentrated Royce Premier Fund and the widely diversified Royce Micro-Cap Fund in 1991. Royce Micro-Cap Trust, also widely diversified and the only closed-end fund focusing on micro-cap securities, followed in 1993.

Chuck Royce with The Royce Funds team at the listing of Royce Micro-Cap Trust on the NYSE

That same year saw also the debut of Royce Small-Cap Total Return Fund, our first mutual fund that focused on dividend-paying small- and micro-cap companies (we ran a similar portfolio for an institutional client that launched in 1979). Dividends were another area in which Chuck was a pioneer. Many still thought of “dividend-paying small-cap company” as an oxymoron, if they thought about it at all. However, our own research and investment experience showed that dividend-paying small-caps outpaced non-dividend-payers—and did so with lower volatility. In 1996, we expanded into the life insurance market with the introduction of two annuity portfolios—a small-cap contrarian value and a micro-cap multi-discipline strategy.

Our team of analysts in the early 1990s

As critical as these changes were to the firm, equally significant were the additions to our investment staff. Two particularly key hires came early in 1998, when Chuck brought on two portfolio managers he had known as respected competitors for many years—Buzz Zaino and Charlie Dreifus. The two small-cap specialists had each developed his own unique investment approach, so their addition to the firm, along with the other new investment professionals hired during the decade, gave us the largest and strongest investment team ever up to that point in our history as well as a more expansive number of small-cap strategies.